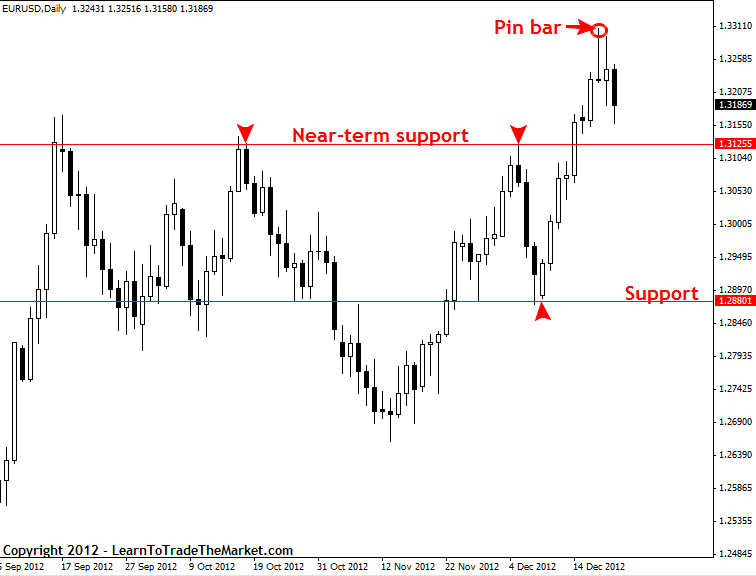

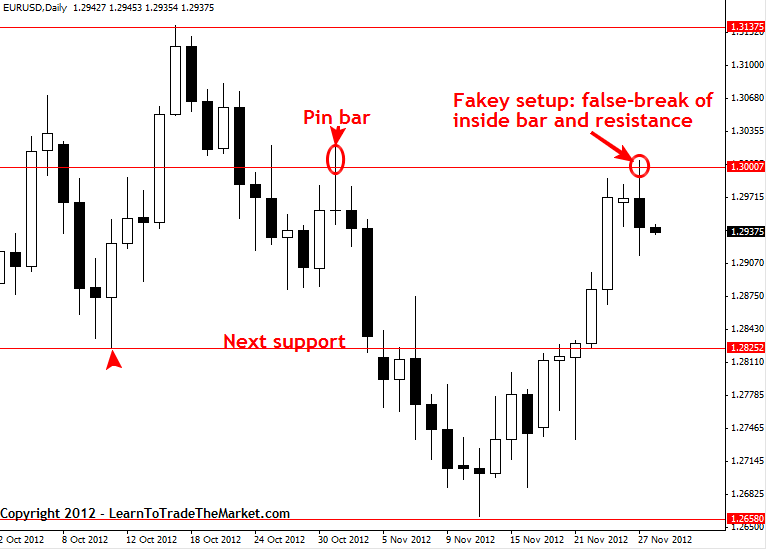

The EUR/USD fell abruptly on Thursday after an early session rally. Today’s potential higher-high, lower-close now has the market in a position to form a secondary lower-top which is usually a sign that it is getting ready to change trend.

After the early session rally, a new main bottom was confirmed at 1.3158. This brought up stops from under the 1.2876 bottom from December 7. According to the trend indicator chart, a move through 1.3158 will turn the main trend down on the daily chart.

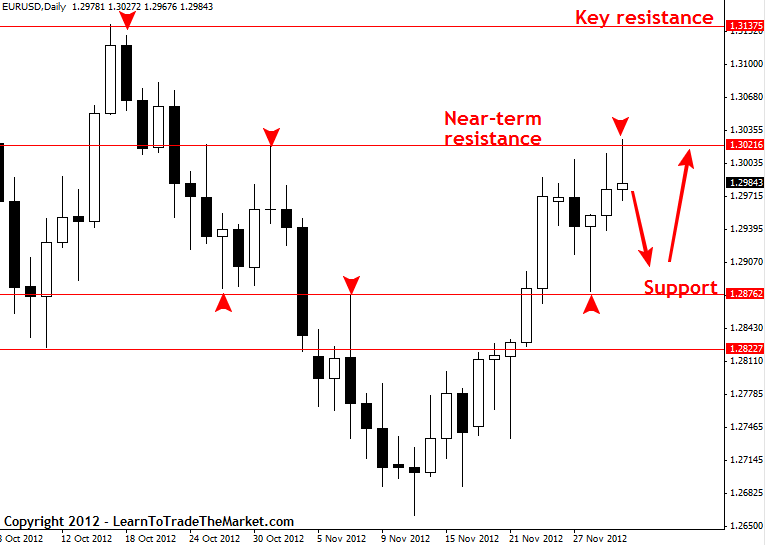

Daily EUR/USD Chart

A Gann angle at 1.3283 helped provide the resistance today from the 1.3308 top. Technically, this set in motion the early selling pressure shortly before news broke that triggered the sharp sell-off. According to the chart pattern on the daily chart, a break through 1.3158 could drive the market into an uptrending Gann angle currently at 1.3136.

This angle has provided strength and direction for the Euro since December 7. A break through it likely means that sentiment has shifted to the downside, making the market vulnerable to a near-term correction into a retracement zone.

Based on the December 7 bottom at 1.2876 to the December 19 top at 1.3308, a normal correction of this range targets a retracement zone at 1.3092 to 1.3041. If downside momentum continues then traders should watch for an eventual break into this zone over the near-term.

Since this has become a news driven market, investors should watch for increased volatility.