EUR/USD Down On Weak French And German GDP

EUR/USD Open 1.3349 High 1.3456 Low 1.3314 Close 1.3358

On Thursday Euro/Dollar decreased with 140 pips. The European currency depreciated from 1.3456 to 1.3314 yesterday, matching the negative money flow sentiment at almost -17%, closing the day at 1.3358. This morning the Euro is trading quietly, with movements at the lower end of yesterday's range for now.

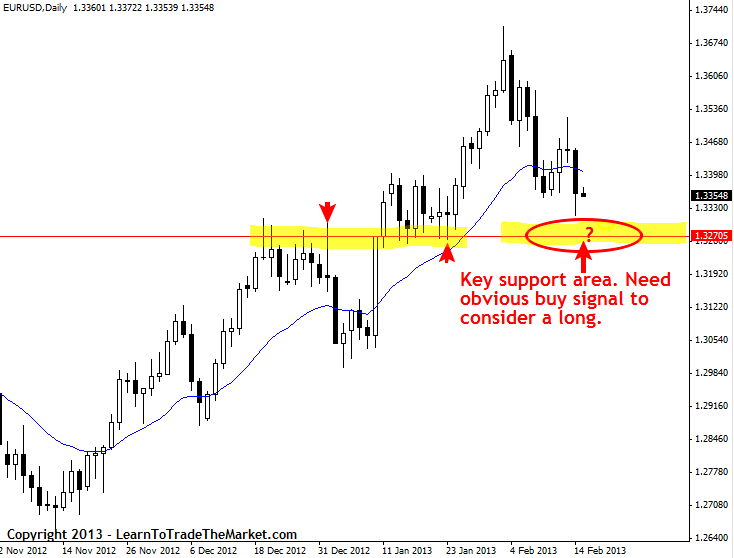

On the 1 hour chart the upward channel has turned into range trading, while on the 3 hour chart the upward channel is on hold. Break above the nearest resistance and yesterday's top at 1.3456 may trigger further strengthening of the Euro. Going bellow yesterday's bottom and first support at 1.3314, however, would confirm continuation of the bearish trend, towards next objective downwards 1.3200.

Today's focus is on EU Trade balance, US NY Fed Empire State manufacturing index, TICS net flows, Industrial production, Capacity utilization, and Michigan sentiment index, at 6:30, 7, 9, 10, and 13:30 GMT respectively.

Quotes are moving bellow the 20 and 50 EMA on the 1 hour chart, indicating bearish pressure. The value of the RSI indicator is negative and calm, MACD is negative and quiet too, while CCI has crossed down the 100 line on the 1 hour chart, giving over all light short signals.

Technical resistance levels: 1.3456 1.3572 1.3700

Technical support levels: 1.3314 1.3200 1.3078

Technical support levels: 1.3314 1.3200 1.3078