Daily Forex Technicals | Written by ICN.com | Feb 18 13 07:15 GMT

Technical Analysis for Major Currencies

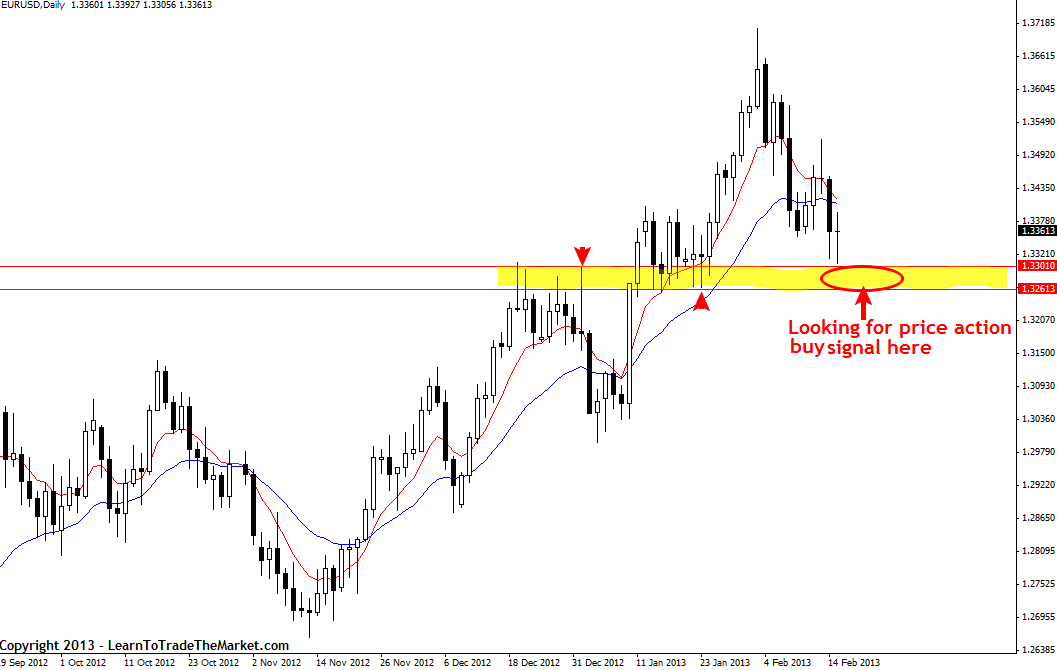

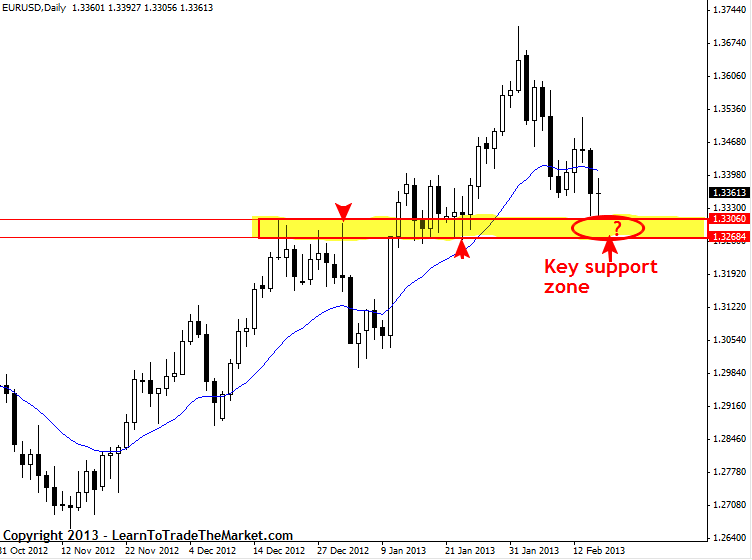

EURO

The pair is still trading negatively, as it started this week negatively below 50% correction of CD Leg of the AB=CD bearish harmonic Pattern. The previously mentioned shows the possibility of extending the second target of the pattern at 1.3270 levels, which by breaching it the bearish move might extend reaching the key support level of the upside move shown on the graph. Linear Regression Indicators supports our negative expectations, but great volatility is expected due to entering oversold areas as shown on Stochastic.

The trading range for this week is among the key support at 1.3150 and key resistance at 1.3545.

The general trend over short term basis is to the upside targeting 1.3990 as far as areas of 1.3350 remains intact.

Support: 1.3305, 1.3270, 1.3235, 1.3170, 1.3120

Resistance: 1.3355, 1.3405, 1.3440, 1.3480, 1.3500

Recommendation Based on the charts and explanations above, our opinion is selling the pair below 1.3355 targeting 1.3305, 1.3270 then 1.3235 and stop-loss with four-hour closing above 1.3405 might be appropriate

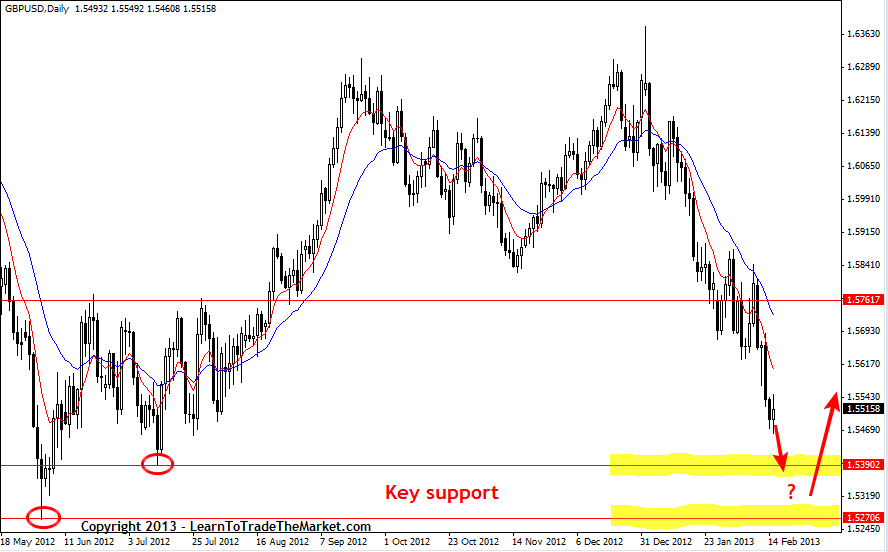

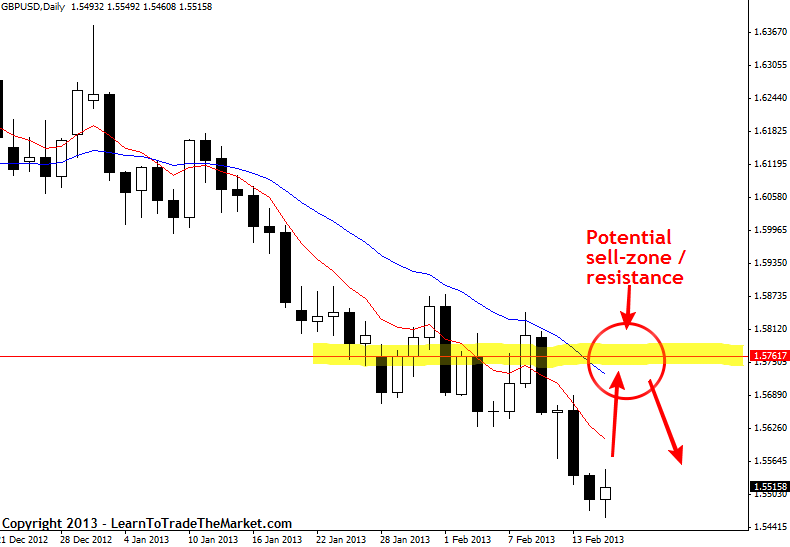

GBP

The pair is still stable below 1.5525 levels which is considered negative and capable of cancelling any oversold signals the pair might show. Linear Regression Indicators are resistances for the pair and leading it to the downside; all of that forces us to think that the bearish move might extend reaching 1.5340 levels during the upcoming short period. Breaching 1.5690 levels will fail our expectations, but this week we prefer stabilizing below 1.5580 levels to keep the possibility of moving to the downside valid.

The trading range for this week is among key support at 1.5340 and key resistance at 1.5690.

The general trend over short term basis is to the downside targeting 1.6875 as far as areas of 1.4225 remains intact.

Support: 1.5455, 1.5415, 1.5380, 1.5365, 1.5340

Resistance: 1.5525, 1.5580, 1.5635, 1.5690, 1.5715

Recommendation Based on the charts and explanations above, our opinion is selling the pair below 1.5525 targeting 1.5415, 1.5380 then 1.5340 and stop-loss with four-hour closing above 1.5635 might be appropriate

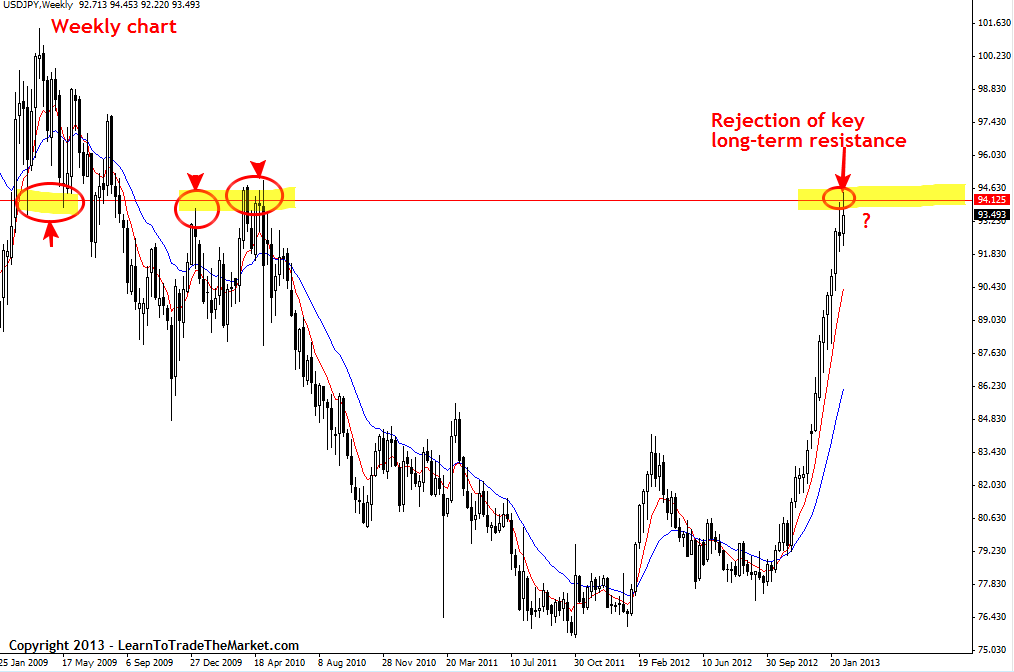

JPY

This week’s trading started positively with the pair, but the rise was due to a price gap that got Stochastic into overbought areas. The pair couldn’t stabilize above key support level of ascending channel that was broken earlier. Therefore, trading below 94.50 levels might bring back the downside move this week. Breaching the mentioned level might test 95.50 levels before any new attempt to the downside.

The trading range for today is among key support at 89.00 and key resistance at 91.70.

The general trend over short term basis is to the upside targeting 91.70 as far as areas of 83.40 remain intact.

Support: 93.30, 93.05, 92.50, 92.05, 91.70

Resistance: 94.00, 94.15, 94.50, 95.15, 95.50

Recommendation Based on the charts and explanations above, our opinion is selling the pair below 94.00 targeting 93.30, 93.05 then 92.05 and stop-loss with four-hour closing above 94.50 might be appropriate

CHF

The pair managed to stay positive and stabilize above Linear Regression Indicators since it stabilized above key resistance level of the downside move as shown on the graph. Stability above 0.9200 levels might extend the bullish move this week, as there might be great volatility and retesting to levels close to the mentioned support level 0.9200 to cover the price gap of this week, in addition to reduce the overbought signals. Trading above 0.9130 levels might extend the upside move.

The trading range for this week is among key support at 0.9080 and key resistance at 0.9425.

The general trend over short term basis is to the downside stable at levels 0.9775 targeting 0.8860.

Support: 0.9200, 0.9170, 0.9155, 0.9130, 0.9080

Resistance: 0.9280, 0.9305, 0.9370, 0.9400, 0.9425

Recommendation Based on the charts and explanations above, our opinion is buying the pair above 0.9200 targeting 0.9280, 0.9305 then 0.9370 and stop-loss with four-hour closing below 0.9135 might be appropriate

CAD

Despite that the pair didn’t breach 1.0085 levels till now, but moving above 1.0055 levels with Friday closing above it weakens the possibility of negativity. Meanwhile, we cannot confirm extending the upside move now till we see the pair reacting around the referred to 1.0085 levels. Therefore, we prefer to remain neutral in our weekly report waiting for confirmation signals.

The trading range for this week is between the key support at 0.9910 and the key resistance at 1.0290.

The general trend over short term basis is to the downside with daily closing below 1.0125 levels targeting 0.9400.

Support: 1.0055, 1.0030, 1.0005, 0.9980, 0.9965

Resistance: 1.0085, 1.0100, 1.0120, 1.0160, 1.0200

Recommendation Based on the charts and explanations above, we remain neutral for now awaiting more confirmations for the next move

AUD

The pair dropped and is still limited above 1.0270 levels. Meanwhile, Stochastic and Linear Regression Indicators are showing negativity, as the pair stabilizes below 1.0345 levels again. These negative conditions should be confirmed by stability below 1.0275 levels, and till that happen we prefer to be neutral.

The trading range for this week is among key support at 1.0085 and key resistance at 1.0440.

The general trend over short term basis is to the downside with daily closing below levels 1.0710 targeting 0.9400.

Support: 1.0270, 1.0220, 1.0200, 1.0165, 1.0135

Resistance: 1.0310, 1.0345, 1.0375, 1.0440, 1.0465

Recommendation Based on the charts and explanations above, we remain neutral for now awaiting more confirmations for the next move

NZD

The pair dropped again and is trading below 0.8480 and 0.8450 resistance levels weakening positivity. Meanwhile, the pair stabilized above Linear Regression Indicators and this week’s negative opening was due to the price gap. Therefore, we might witness a new attempt to the upside by stabilizing above 0.8355 levels this week. Stochastic is showing a negative bias that requires stability again above 0.8480 to cancel it.

The trading range for this week might be among key support at 0.8310 and key resistance at 0.8600.

The general trend over short term basis is to the upside with steady daily closing above 0.8130 targeting 0.8845.

Support: 0.8415, 0.8380, 0.8355, 0.8310, 0.8275

Resistance: 0.8450, 0.8480, 0.8500, 0.8520, 0.8565

Recommendation Based on the charts and explanations above, our opinion is buying the pair above 0.8415 targeting 0.8480, 0.8535 then 0.8620 and stop-loss with four-hour closing below 0.8355 might be appropriate