The EUR/USD pair fell for much of the session on Wednesday, but as you can see towards the end of the day we got a bit of a bounce in order to form a hammer. With even more interesting is the fact that this hammer sits right on top of an up trending line, as well as the 50 day moving average. Because of this, we feel that bullish action in this pair may be seen during the session today.

This sets up an interesting situation, as a break of the bottom of the hammer would be a very bearish sign and have the market falling. However, a break of the top of the hammer would be a sign that we are going higher, and are going to retest that 1.3150 level that had been so supportive previously. When you get a situation like this, it creates a lot of pressure and we could see an explosive move in one direction or the other. Because of this, we think that something significant will happen in this pair fairly soon, but right now is far too early to determine what.

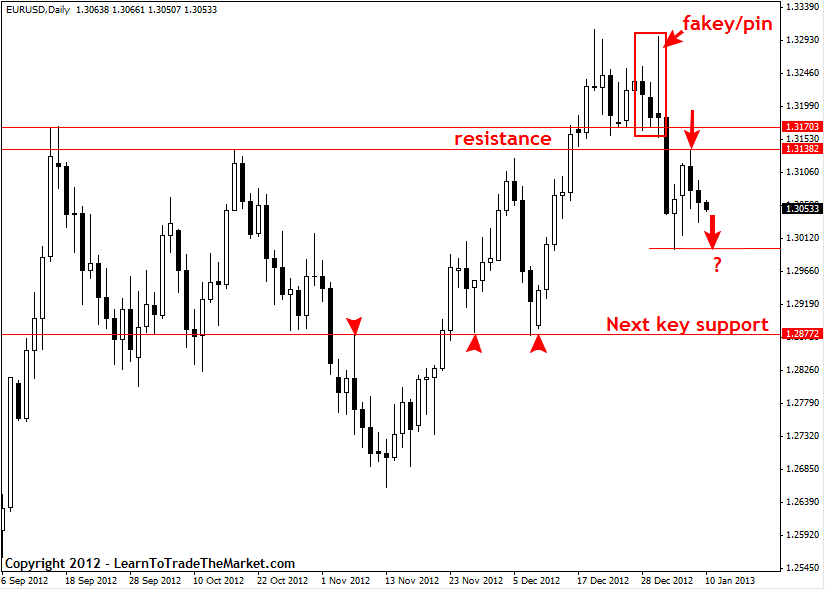

Looking at this chart, we think that the area between 1.3150 and 1.33 will be extremely resistive, so we think that the up move will be somewhat limited. A move into that range and a resistant candle would be an excellent selling signal to be honest, and as such we fully expect to see a lot of choppiness over the next several sessions. However, having said that it does appear that Thursday could be fairly positive.

This pair has been very difficult to trade over the last several months simply because it is a reflection on whether or not people focusing on the United States and its fiscal problems, or the debt issues in Europe that haven’t actually been worked out yet. The markets have been looking at these two currencies as proxies for whatever they are focusing on and sending money in the appropriate direction as it crosses back and forth over the Atlantic Ocean.

EUR/USD Forecast January 10, 2013, Technical Analysis