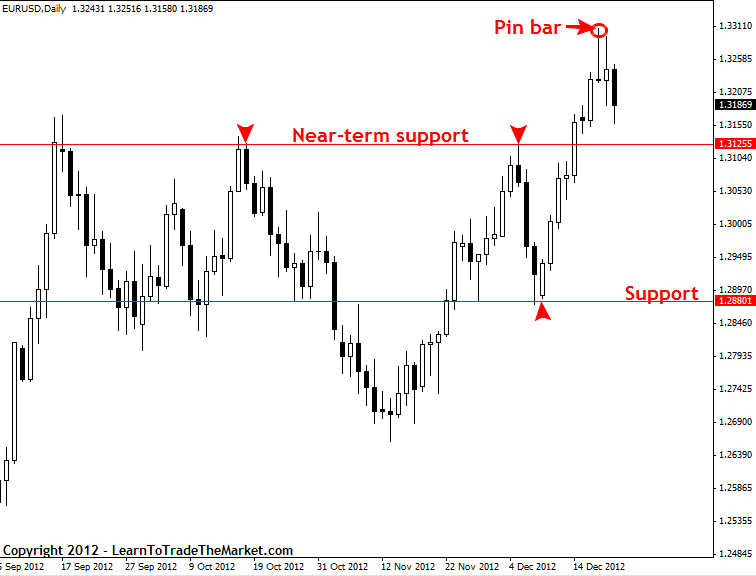

The EUR/USD pair fell on Friday, but found quite a bit of support at the 1.3150 handle as it bounced from that significant level. With Wednesday and Thursday both printing shooting stars, and the Friday candle pretty when essentially looks like a hammer, it appears this market ready to consolidate in this general vicinity. This is not surprise to us as the week ahead is a holiday week, and as such most traders won’t be willing to take large positions. However, or break down below the 1.3150 level would be a very sign that we could continue much lower, but a break above the 1.33 handle is very bullish. Until we get one of these moves, this pair will more than likely sit still.

EUR/USD Forecast December 24, 2012, Technical Analysis