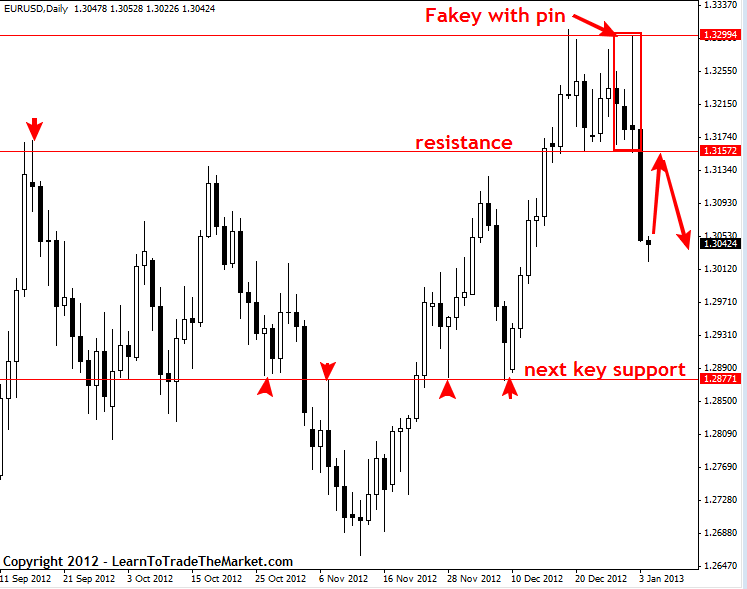

The EUR/USD pair collapsed during the session on Thursday as the shooting star from the previous session set up this potential sell signal. We had suggested that the 1.3150 level will offer support during the session, and if it gave way this would open the door to lower prices. As you can see, this is exactly what happened and the fact that we are closing at the very lows of the session suggests that there will be further selling pressure ahead. We suggested that a move down to 1.29 would be very likely, and nothing in this chart says to us that we should change our opinion.

Looking forward, we think this move to 1.29 could be helped along if we get a poor jobs number today, and that is one reason that we may not be in the market. However, we already have some gains from selling this pair and think that going forward that will be the way to go at least in the short-term. Over the longer-term, it’s hard to tell, as it is a risk sensitive pair above the European Union has been an absolute disaster over the last year or two, along with the United States and this is made trading this currency pair very difficult in particular.

The Federal Reserve release the minutes during the session on Thursday and as a result the market got spooked as it appears there were more than previously known members looking to get out of the quantitative easing gain. Once the free money runs out, a lot of the bullishness in the stock market and other risk asset markets will find themselves running for the exits. This may have been a small preview of things to come that we saw in the currency markets during the Thursday session.

We think the rallies that failed to get above the 1.3150 level will offer nice selling opportunities, as would continue deterioration of this pair down to the 1.29 handle. As far as buying is concerned, we would have to break above the 1.33 level in order to do so at this point time, and this is something that we will see happening anytime soon.

EUR/USD Forecast January 4, 2013, Technical Analysis