วันจันทร์ที่ 7 มกราคม พ.ศ. 2556

EURUSD Forecast 7/1/2013 Daily

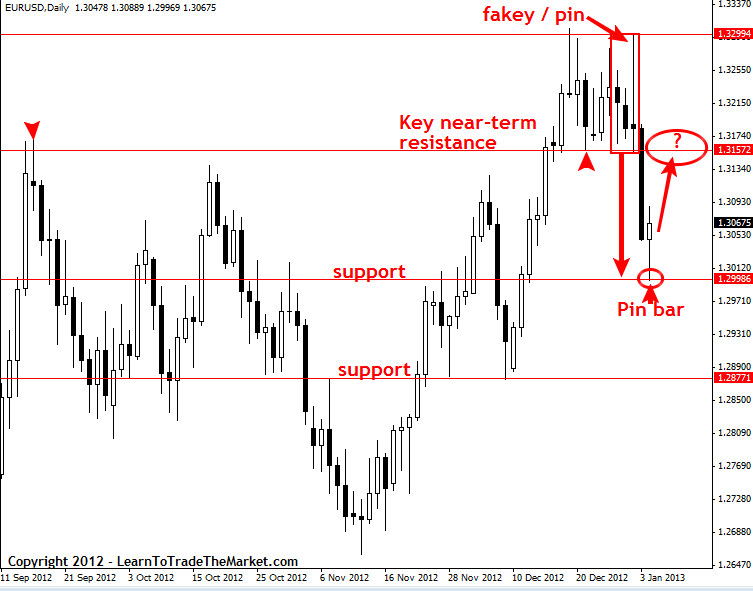

EURUSD 7/1/2013 D1

คอยจับตาตรงช่วงแนวรับให้ดี ถ้าผ่านไปไม่ได้ ก็จะกลับขึ้นไปต่อ

ส่วนตัวยังมองว่ามีโอกาสกลับขึ้นได้อยู่

Weekly Price Action Trading Outlook for January 7th to January 11th 2013

UR/USD – Euro/dollar under pressure below 1.3300

The EURUSD fell significantly lower last Thursday on the back of the fakey with pin bar combo setup that formed last Wednesday. It’s clear by looking at this chart that near-term momentum shifted from bullish to bearish after the consolidation between 1.3155 – 1.3300 broke to the downside last week. However, Friday brought us a bullish pin bar reversal showing rejection of 1.3000 support and indicating the market could pop higher early this week. The market will need to have enough strength to close back above 1.3155 resistance to really make a substantial run higher, and there’s some serious resistance really from 1.3155 up through 1.3300 it would need to clear to extend the uptrend. Overall, there’s some strong “headwinds” facing this market right now and although we see a pin bar formed on Friday and technically the daily chart is showing a pattern of higher highs and higher lows, we could see some stalling and bearish price action emerge around 1.3155 – 1.3300 next week and could even look to sell in that resistance area if an obvious price action sell signal forms.

EUR/USD Forecast January 7, 2012, Technical Analysis

The EUR/USD pair had a slightly positive session for the Friday trading day, bouncing off of the 1.30 level. However, we think that the 1.3150 level above should continue to be resistant, and as a result we think that this market is prone to falling in the near-term. Looking at this candle, it appears we could get a mall rally, and we think this will simply be a chance to sell this pair form higher levels. The area above that should be massive resistance, and because of this we think this pair remains weighted more than anything else. At this point though, we see no real trade set ups.

EUR/USD Forecast January 7, 2012, Technical Analysis

Euro (€) / US Dollar ($) (EUR/USD) Mid-Session Update for January 4, 2013

The EUR/USD is rebounding at the mid-session following an early sell-off. Overnight the market took out an uptrending Gann angle at 1.3056 and a Fibonacci price level at 1.0341. Once this support cluster was broken, sell stops were hit and the market broke sharply toward another uptrending Gann angle at 1.2966.

Daily EUR/USD Chart

A shift in sentiment following the release of the U.S. Non-Farm Payrolls report led to an intraday reversal which has put the Euro in a position to finish the day higher. If the market can build support over 1.3041 throughout the day, then the odds are strong the EUR/USD will finish higher.

Since the main trend is down on the daily chart, the rally is likely to be short-lived as sellers are probably waiting to re-establish their positions. This selling pressure is likely to re-emerge at 1.3139.

สมัครสมาชิก:

บทความ (Atom)