A strong surge in the U.S. Dollar is triggering a rapid sell-off in the Euro at the mid-session. The move is also putting a bearish spin on U.S. equity markets which could be a sign of increased demand for lower-yielding assets.

Although the news isn’t clear at this time, developments in the debt ceiling negotiations may be spooking traders. If the deal to extend the debt ceiling by four months gets taken off the table, the Euro may weaken further as this would indicates a serious shift in sentiment to safety.

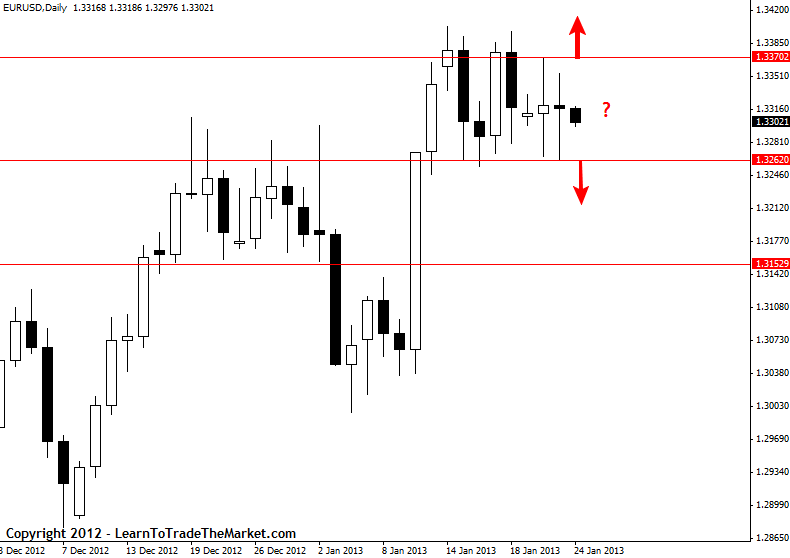

Daily EUR/USD Chart

Technically, the EUR/USD is trading in a short-term range bounded by 1.3403 to 1.3256. The mid-point or pivot price of this range is 1.3330. For much of the session, the Euro straddled this pivot price, suggesting an indecisive market. Shortly before the mid-session, the market broke sharply, stopping short of an uptrending Gann angle at 1.3257.

The main bottom at 1.3256 and the Gann angle at 1.3257 combine to form an important support cluster. Because of the downside momentum, traders have to watch this cluster carefully. A failure to hold at this level should trigger a rapid break. Not only will the trend change to down on the trade through 1.3256, but last week’s weekly closing price reversal will also be confirmed.

Hourly EUR/USD Chart

A confirmation of the weekly reversal will set up a further decline. Since the main range is 1.2997 to 1.3403, traders should watch for a near-term correction into its retracement zone at 1.3200 to 1.3152.

The 60-minute chart shows that the market has been range bound for several hours. It also shows clearly that a trade through 1.3256 could trigger an acceleration to the downside since the nearest support level is 1.3038.