วันศุกร์ที่ 30 พฤศจิกายน พ.ศ. 2555

EUR/USD Forecast November 30, 2012,By FX Empire Analyst - Christopher Lewis

The EUR/USD pair rose during the session on Thursday, but gave back about half of its gains for the day by the time we closed. The 1.3050 level continues offer resistance, and the candle almost looks like a shooting star. However, we have a hammer from the session before on Wednesday, and it does look like it is well supported. In other words, this pair seems to be trading right along with news coming out of United States on the so-called “fiscal cliff.” This is a surprise, and we do expect choppy conditions going forward. However, we would be buying this market above the 1.3050 level, and selling it below the 1.29 level that offered support.

EURUSD Forecast 30/11/2012 Daily

ยังคงเป็นขาขึ้นอยู่ อาจจะลงมาที่ pivot ก่อนบ่าย จากนั้นอาจจะขึ้นต่อ ถ้าผ่าน hi เดิมได้ ก็คงยาว

วันนี้ให้ Buy 70%

วันพฤหัสบดีที่ 29 พฤศจิกายน พ.ศ. 2555

EUR/USD Forecast November 29, 2012,By FX Empire Analyst - Christopher Lewis

The EUR/USD pair fell most of the day on Wednesday as the “risk off” trade came back into play. Looking this chart, we actually have a decent sell signal at the beginning of the session, but you can see this is been completely reversed again. This was predicated upon the headline events, mainly talking points of the Speaker of the House and the President during the session. In other words, we are now in a situation where the U.S. Congress will have complete control of this currency pair. For the moment however, it does look like we’re going to try to go higher. A break of the day’s highs would technically be a buy signal, but we are more than likely going to ignore this pair for the next couple of sessions as the volatility should do nothing but increase. We are not at either one of the extremes of the consolidation area, so we don’t see any “Grade A” type of trades.

Forex Commentary EURUSD , 29th November 2012

EURUSD – Euro/dollar pares early session losses to end today higher

The EURUSD fell lower early today on the back of the bearish fakey we discussed in yesterday’s commentary. However, price recouped all losses to end the day slightly higher, forming a bullish pin bar in the process. If the market can remain buoyant and break up above the near-term resistance around 1.3000, we could eventually see a re-test of the key resistance around 1.3150 area.

EURUSD Forecast 29/11/2012 Daily

EURUSD 29/11/2012 D1 H4

แนวโน้มใหญ่ยังคงเป็นขาขึ้น จากที่เคยได้บอกว่ากราฟอาจจะลงมาพักตัว เมื่อคืนกราฟได้เด้งขึ้นมาอาจจะหมดช่วงพักตัวแล้วก็ได้ ถ้าลงมาไม่ผ่าน low เมื่อวาน เป็นไปได้สูงว่าจะไปเทส Hi เดิม ของอาทิตย์ที่แล้ว

วันนี้ให้ Buy 70%

วันพุธที่ 28 พฤศจิกายน พ.ศ. 2555

Forex Trade Setups Commentary: EURUSD Fakey Setup, 28th November 2012

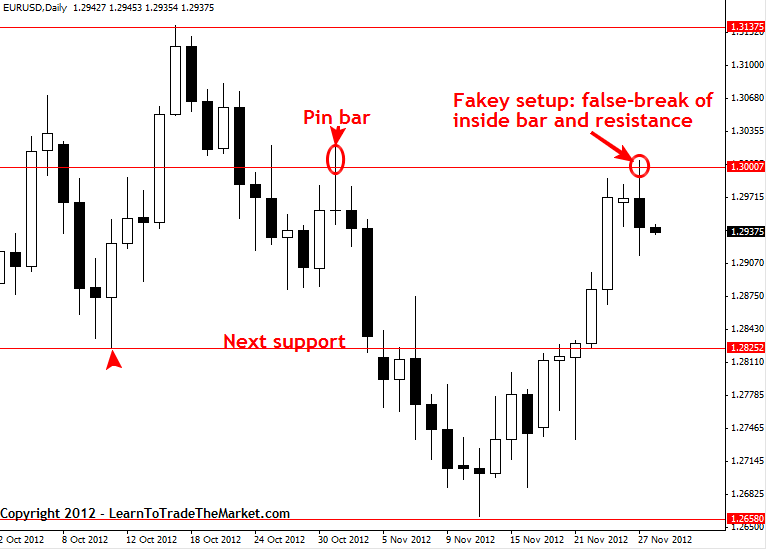

EURUSD – Euro/dollar fakey setup forms at near-term resistance

The EURUSD tried to extend its recent run higher today but ran into resistance just above 1.3000 and made a false-break of that resistance as it pared gains later in the day to close lower. We can see that price also formed a fakey trading strategy as price first made a false-break to the upside of yesterday’s inside bar pattern before moving lower into the New York close and triggering an entry on the fakey setup when price broke back below the low of yesterday’s inside bar. We could see more losses in this market this week as long as price stays below 1.3000 on a closing basis. The next support is seen down near 1.2825. If price drifts higher and closes back above 1.3000 it would invalidate this bearish fakey and open the door for higher prices.

credit : Forex Trading Commentary by Nial Fuller

The EURUSD tried to extend its recent run higher today but ran into resistance just above 1.3000 and made a false-break of that resistance as it pared gains later in the day to close lower. We can see that price also formed a fakey trading strategy as price first made a false-break to the upside of yesterday’s inside bar pattern before moving lower into the New York close and triggering an entry on the fakey setup when price broke back below the low of yesterday’s inside bar. We could see more losses in this market this week as long as price stays below 1.3000 on a closing basis. The next support is seen down near 1.2825. If price drifts higher and closes back above 1.3000 it would invalidate this bearish fakey and open the door for higher prices.

credit : Forex Trading Commentary by Nial Fuller

EUR/USD Forecast November 28, 2012,By FX Empire Analyst - Christopher Lewis

The EUR/USD pair fell below the bottom of the hammer from the previous day on Tuesday, and this of course is a massively bearish signal. The fact that we are closing below the lows on Monday suggests that we will be going lower.

It should also be noted that the top of the Monday and Tuesday candle was at roughly the 1.3000 level, and this suggests that there is a taunt of resistance at this area. With this in mind, we would be more than interested in selling the breaking of the Tuesday lows as it should signal a return to the 1.27 level before it’s all said and done.

EURUSD Forecast 28/11/2012 Daily

ยังคงมองว่าเป็นขาขึ้นอยู่ จากเมื่อวานกราฟทำตัวลงมา คงลงมาแค่พักตัว วันนี้อาจจะมีแกว่งลงมาก่อนแล้วค่อยขึ้น ถ้ากราฟยังลงต้องดูว่าลงมากแค่ไหน เพราะถ้าจะเป็นขาลงจริงๆคงต้องลงมาเยอะพอสมควร

วันนี้ให้ Buy 70%

วันอังคารที่ 27 พฤศจิกายน พ.ศ. 2555

EUR/USD Forecast November 27, 2012,By FX Empire Analyst - Christopher Lewis

The EUR/USD pair fell initially during the Monday session but bounced in order to form a hammer. This hammer is at the top of a significant move higher, so it can be considered a sign of continuation. However, if we managed to break the bottom of this hammer this would be a very bearish sign and make the hammer a “hanging man.” This of course would be a very bearish sign.

However, if we managed to break the highs from the Monday session we think that this market makes another attempt on the 1.3150 level above. The level has been extremely resistive, and as such we don’t suspect that it will be broken through easily. Because of this, we may have a situation where you can buy this pair above the 1.30 level (essentially the highs from Monday) and then sell it about 150 pips higher.

EURUSD Forecast 27/11/2012 Daily

EURUSD 27/11/2012 H1

เหมือนว่ากราฟมันจะยังขึ้นไม่สุด เช้าวันนี้เลยกระชากขึ้นไปแต่ก็กลับลงมาทันควัน

วันนี้ก็ยังมองมาต้องลงมาพักตัว(ถ้ามันขึ้นสุดแล้วนะ) วันนี้อาจจะลงมาอย่างเดียวก็ได้

วันนี้ให้ Sell 70%

วันจันทร์ที่ 26 พฤศจิกายน พ.ศ. 2555

Weekly Forex Price Action Chart Outlook for November 26th – November 30th 2012

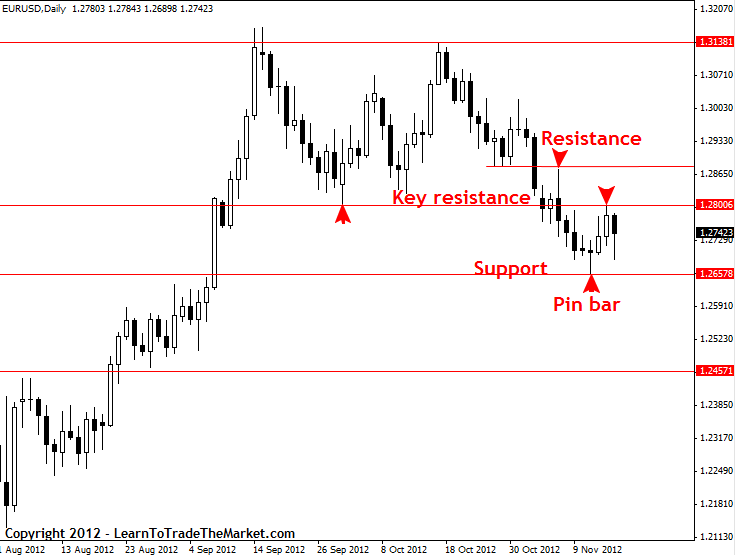

EURUSD – Euro/dollar surges higher on fresh bullish momentum

The EURUSD moved significantly higher on Thursday and Friday of last week after forming a bullish pin bar on Wednesday that pushed the market back into its previous trading range between about 1.3150 resistance area and 1.2800 support. This week, if the bullish momentum continues, the market will face some near-term resistance around 1.3020, beyond that we see key resistance between 1.3130-1.3170 area. In the near-term, if this market pulls back to support near 1.2825 area and forms an obvious 4 hour or daily chartprice action buy signal, we would consider a long entry to trade back up towards the resistance we just discussed and in-line with the fresh bullish momentum in this market. We would also consider selling if the market moves up into one of the resistance levels just mentioned and forms an obvious 4 hour or daily chart price action sell signal.

EUR/USD Forecast November 26, 2012,By FX Empire Analyst - Christopher Lewis

The EUR/USD pair rose during the session on Friday as the Euro continues to gain. Overall, the currency looks very strong at the moment, and it appears that we are heading towards the 1.3150 level before it’s all said and done.

This is the top of the recent consolidation area, and it appeared to the 1.27 level is going to act as support based upon longer-term charts. With that being said, a breakout above the 1.3150 level seems unlikely before the New Year’s though, as there will be less and less trading going forward. Also, there is also the possibility that the United States government will choose to go over the so-called “fiscal cliff”, which ironically will cause a flood into US Treasuries, pushing the value of the Dollar higher. With that being said, we do have potential to have a strong downdraft in this pair, but more than likely we will simply see it bounce around as fears focus on one side of the Atlantic versus another, and then vice versa.

EURUSD Forecast 26/11/2012 Daily

EURUSD 26/11/2012 D1 H4 H1

จากกราฟ D1 กราฟขึ้นมาผ่านแนวต้านได้ และเป็นเทรนขาขึ้นในวันนี้หรืออาจจะถึงสุดสัปดาห์ อาจจะลงมาพักตัวแล้วขึ้นต่อ

การลงมาพักตัวอาจจะประมาณตามลูกศรของภาพกราฟ H4 และ H1 แต่ถ้าเจอข่าวแรงๆแล้วรับไม่อยู่ต้องค่อยดูสถานการณ์อีกที

วันนนี้ให้ เตรียมตัว Buy 80% ให้ลงมาพักตัวก่อน

วันพฤหัสบดีที่ 22 พฤศจิกายน พ.ศ. 2555

EURUSD Forecast 23/11/2012 Daily

EURUSD 23/11/2012 D1 และ H4

จากกราฟ H4 ยังมองว่าเป็นขาขึ้น และอยู่ในช่วงกำลังลงมาพักตัวตามลูกศรสีฟ้า แล้วก็ขึ้นไปต่อตามเทรน

แต่พอมามองที่กราฟ D1 ขึ้นมาใกล้แนวต้าน ถ้าผ่านไปได้ อาจจะเป็นขาขึ้นสอดคล้องกับ H4 แต่ถ้าผ่านไม่ได้อาจจะลงมาถึง Low เดิมเลย ถ้าเทียบกับ H4 ก็จะเป็นลูกศรปะสีแดง

วันนี้ให้ Buy 60% (วันศุกร์แห่งชาติ)

ปล. พรุ่งนี้ผมไม่อยู่เลยคาดการณ์ก่อนเลย

EUR/USD Forecast November 22, 2012,By FX Empire Analyst - Christopher Lewis

The EUR/USD pair fell during the Wednesday trading session in order to test the 200 day simple moving average again. This also reaffirmed the supportive nature of the 1.27 to 1.28 support zone. With the hammer that formed for the trading session, it looks more and more obvious that the Euro is looking to head back into the previous consolidation area between 1.28 and 1.3150 or sell. This is especially interesting as there are still failures to get a consensus on what to do about giving Greeks their money. With all this being said, the fact that the Euro continues to be buoyant is indeed a telling sign in and of itself.

On a break above the highs from the Wednesday session, we believe this market is suddenly a buy. We don’t necessarily think that some massive move waiting to happen, but we could see the Euro gain strength in the near-term.

EURUSD Forecast 22/11/2012 Daily

EURUSD 22/11/2012 H4 และ H1

กราฟ H4 ผ่านแนวต้านเส้นเทรนไลน์ขาลงได้แล้ว คาดการณ์ว่าจะลงมาพักตัวตามแนวต้านเก่า แล้วขึ้นไปทำ High ใหม่

ส่วนกราฟ H1 มองแนวโน้มเหมือน H4 คือ ลงมาพักตัวตามแนวรับต่างๆแล้วขึ้นต่อ

วันนี้ให้ Buy 80% (หลังจากลงมาพักตัวตามแนวรับแล้วค่อยเข้า order)

วันพุธที่ 21 พฤศจิกายน พ.ศ. 2555

EUR/USD Forecast November 21, 2012,By FX Empire Analyst - Christopher Lewis

EUR/USD finally closed above the 1.28 level as that resistance area has been slowly chipped away over the last couple of weeks. With this being said, it is a bullish sign and we would consider the possibility of going long of this pair. However, we need to clear the next couple of minor resistance points to be completely comfortable in doing so. This does suggest however, the we would return to the consolidation area between 1.28 and 1.3150 or so.

The biggest problem with trading this pair to the long side is the fact that there are so many European debt issues right now. However, as Congress in the United States has come to the aid of Europe, it appears that the US dollar may be weakening because of the lack of cooperation between the two parties in Washington DC. Essentially, they have given the Euro a lifeline at this point time.

With the looming “fiscal cliff” looming, there are a lot of people who are concerned about the US dollar right now. Ironically, if the fiscal talks break down and we do fall over that cliff, it’s very likely that the US dollar will appreciate in value as traders will simply abandon anything remotely close to a “risk on” trade. US Treasury notes will more than likely be the flavor of the day, and this of course will push money into the US dollar.

If that’s the case, the Euro will suffer. However, in the near-term it does look like the fear is pushing the Dollar a little bit lower, and there’s also a certain amount of “hopium” in the marketplace right now that some type of deal will be worked out. After all, they would actually go over the cliff would they? To be honest, it’s not only possible, it’s very likely that the only thing that will stop it is some type of “Band-Aid” solution.

With all this being said, we think there is a little bit of upside for the Euro still, but we think that this is going to be one of the more dangerous and erratic markets going forward as we enter a low liquidity part of the year, and certainly have negative headlines waiting to come out from both sides of the Atlantic right now. A break above the 1.2850 level would be enough to get us buying this pair, just as a break below the 1.2780 level would be enough to get us to start selling again.

EURUSD Forecast 21/11/2012 Daily

EURUSD 21/11/2012 H4

จากหลายวันที่ผ่านมา กราฟยีงไม่สามารถผ่านแนวต้าน EMA200 ได้ คาดว่าอาจจะกลับลงมาก่อน แล้วค่อยขึ้นไปทดสอบแนวต้านอีกราอบ

วันนี้ให้ Sell 70%

วันอังคารที่ 20 พฤศจิกายน พ.ศ. 2555

EUR/USD Forecast November 20, 2012,By FX Empire Analyst - Christopher Lewis

EUR/USD trying to rally through the 1.28 level on Monday, but failed in the end. This has been an area that has been causing quite a bit of headaches for the buyers, and it looks like it is said to do so going forward.

Looking at this chart, it does appear that the next 50 or so pips will be very important to the next leg of this trade. If we do manage to break the top of the shooting star from Monday, it’s very likely that we would continue higher. However, this would only be a move back into consolidation, as opposed to some type of large rally.

With this in mind, we are still bearish of this pair for the moment. We could see a bit of a “risk on rally” continue in the markets in general, but the fact that the Euro could hang onto the gains that it had achieved earlier in the day makes is very suspicious of Euro strength in the long run. After all, the stock markets around the world rallied extensively. As a matter fact, the Dow Jones Industrial Average gained almost 200 points at the end of the session. In a situation like this, the Euro almost always explodes to the upside against the Dollar. The fact that it didn’t certainly suggests that something isn’t quite right.

Looking forward, this pair is still going to have more risk to the downside than the upside. After all, the debt crisis in Europe is far from being fixed, and there is always some type of headline risk waiting around the corner. On top of that, one has to think that the congressional leaders in the United States aren’t exactly ready to sign a fiscal deal either, and as such bad headlines could come across that think this pair any moment.

With this in mind, we are much more comfortable selling this pair than buying it. However, if we do manage to break above the shooting star from the Monday session, we would have to admit that there is at least a chance that we could see some type of momentum shift for the short-term. We would need to see a daily close above that in order to be impressed out, and that is the big difference. After all, the Monday session Saul a breakthrough of the 1.28 resistance level, only to fail. Because of this we will be very cautious about buying this pair and wait until we get a daily close to convince us.

EURUSD Forecast 20/11/2012 Daily

EURUSD 20/11/2012 H4 และ H1

การเทรดวันนี้อาจจะขึ้นได้อีกหน่อย เพราะ ยังมองว่าเทรนหลักยังคงเป็นขาลง ตอนนี้เป็นเพียงการขึ้นในขาลงเท่านั้น และถ้ากราฟขึ้นไปทดสอบเทรนไลน์ใน H4 และ ผ่านไปได้คงต้องมามองกันใหม่

วันนี้ให้ Buy 70% TP อยู่ที่ high เดิมของเมื่อวาน

วันจันทร์ที่ 19 พฤศจิกายน พ.ศ. 2555

Weekly Forex Price Action Chart Outlook for November 19th – November 23rd 2012

EURUSD – Euro/dollar trading just below resistance

The EURUSD is still moving lower overall, however last week we saw the market stage a modest rally after finding support at 1.2660 and then forming a bullish pin bar / fakey from that level. The market then rallied up into 1.2800 key resistance but was unable to close above that level last week. This week, if the market remains contained below 1.2800 we will expect the downtrend to remain intact. If the market rallies and closes above 1.2800 however, it would open the door up for more gains.

EUR/USD Forecast November 19, 2012,By FX Empire Analyst - Christopher Lewis

The EUR/USD pair fell during the session on Friday, but did bounce off of the 1.27 support level. The resulting candle is somewhat like a hammer, and does show some support in this general vicinity. However, we think that the headline risks over the next couple of weeks will more than likely make is a very short-term traders market. We suggest that a bounce could come from here, but 1.28 will more than likely cause some type of resistance as well.

With that being said, we think that the market will be very tight, and short-term charts should be used if you feel the absolute need to be in this market. Going forward, we will need to see some type of serious breakout, and we think that the Tuesday hammer below would be an excellent selling signal if we can get below it. As far as buying is concerned, we need to clear the 1.28 level handily on a daily close.

EURUSD Forecast 19/11/2012 Daily

EURUSD 19/11/2012 H4

เทรนหลักยังคงเป็นขาลงใน D1 คาดการณ์ว่าอาจจะขึ้นไปทดสอบแนวต้าน ถ้าไม่ผ่านก็ลงมาทดสอบแนวรับ ถ้าผ่านไปฝั่งใดฝั่งหนึ่ง ให้เปิด order ตามน้ำไปเลย

ส่วนตัวแล้วให้ Sell 60% (ส่วนมากวันจันทร์กราฟเคลื่อนตัวน้อย แต่ก็ไม่แน่เสมอไปนะครับ)

วันศุกร์ที่ 16 พฤศจิกายน พ.ศ. 2555

EUR/USD Forecast November 16, 2012,By FX Empire Analyst - Christopher Lewis

The EUR/USD pair rose during the Thursday session in order to retest the 1.28 resistance level. Also, you can see that the 100 day exponential moving average is plotted on this chart, and it has offered resistance for the second day in a row. This market looks like it’s trying to break out to the upside, but we will not be convinced until we close above 1.2850 or so, as it would show a shift in momentum. This market looks a bit clustered at this point in time, but we do prefer the down side over the upside as there is so many problems with Europe entering recession.

We will be looking for weakness to sell on short-term trades, but don’t expect anything big in the next 24 hours or so.

EURUSD Forecast 16/11/2012 Daily

EURUSD 16/11/2012 H1

จุดเข้าประมาณเส้นแดงตามรูป

วันนี้ให้ Buy 80%

วันพฤหัสบดีที่ 15 พฤศจิกายน พ.ศ. 2555

EUR/USD Forecast November 15, 2012,By FX Empire Analyst - Christopher Lewis

The EUR/USD pair shot straight up during the session on Wednesday, but gave up quite a bit of its gains in order to form something that looks quite a bit like a shooting star. The market could rise above the 1.28 level, and as the Americans sold off the stock markets in the afternoon of New York-based trading, the US dollar gained as people rushed into the bond markets.

We are extremely bearish of the Euro right now, and we believe that this rally was simply use by the sellers in order to get involved and initiate fresh positions. At this point time, the hammer that was formed on Tuesday is the support that the sellers have to break through. If we can get below the lows on Tuesday, this market will fall much further. As for buying, we would have to close substantially above the 1.28 level, something that doesn’t look overly possible at the moment.

EURUSD Forecast 15/11/2012 Daily

กราฟได้ทำการ break เทรนไลน์ลงเส้นแรกแต่ยังไม่ยืนยัน

กราฟลงมาโดนแนวรับตามรูป ถ้าผ่านไม่ได้น่าจะขึ้นไปทดสอยแนวต้านต่อๆไป

บวกกับกราฟ D1 มีสัญญาณกลับตัวค่อนข้างชัดเจน(80%)

การกลับตัวนี้ยังถือว่าอยู่ในเทรนขาลงของ D1 อยู่นะ ครับ อาจจะแค่กลับตัวขึ้นเพื่อไปพักตัวก็ได้

แต่สำหรับวันนี้ ให้ Buy 80% ถ้าราคาสามารถยืนเหนือ pivot 1.2737 ได้

วันพุธที่ 14 พฤศจิกายน พ.ศ. 2555

EUR/USD Forecast November 14, 2012,By FX Empire Analyst - Christopher Lewis

The EUR/USD pair fell below the 1.2700 level on Tuesday, but did get a bounce in order to pop back above it. Currently, we are flirting around with that handle, and have formed what looks a lot like a hammer right now. This area has to hold if the buyers want to get bullish again.

Alternately, if we managed to break the lows from the session on Tuesday, we think this pair goes down to the 1.25 handle. Even if we do manage to break the top of the hammer from the Tuesday session, we see the 1.28 level as being very resistive. Because of this, we think that any trade in this pair based upon those two parameters will be relatively short term.

EURUSD Forecast 14/11/2012 Mid Daily

EURUSD 14/11/2012 M15 Mid Daily

ตามรูปเลยครับ ถ้าหลุด channel ได้ อาจจะลงได้ตามลูกศรสีฟ้า

ถ้าไม่หลุดก็ยังคงไปตาม channel ต่อ ตามลูกศรสีแดง

ถ้าหลุด channel แต่ลงไมถึงลูกศรสีฟ้า อาจจะ sideway

โอกาส Buy 70% (ยังอยู่ใน Channel)

EURUSD Forecast 14/11/2012 Daily

EURUSD 14/11/2012 H4

ให้รอดูกราฟ ถ้าผ่านแนวต้านไปได้ Buy ได้เลย แต่ถ้าไม่ผ่านยังพอมีโอกาส Sell

เนื่องด้วย กราฟ D1 ของ วันที่ 13/11/2012 เป็น Doji เป็นสัญญาณกลับตัวขึ้น

วันนี้ให้ Buy 70%

วันอังคารที่ 13 พฤศจิกายน พ.ศ. 2555

Trading System : FiboLucky By ForexThaiPlus

สำหรับหัวข้อนี้ จะแชร์ ระบบที่ผมใช้อยู่ ฟรีๆเลย คงเป็นแนวทางให้ใครหลายๆคนได้ไม่มากก็น้อย

สามารถเข้าไปดูได้ที่ Trading System By ForexThaiPlus

ขอบคุณสำหรับการติดตามครับ

EURUSD Forecast 13/11/2012 Mid Daily

EURUSD 13/11/2012 H1 Mid Daily

ยังคงคิดว่า Sell อยู่ แต่อาจจะขึ้นมาพักตัวไม่มาก

โอกาส Sell 80% จุดเข้า ตั้งแต่ Support 1(1.2699) - Pivot (1.2715)

*** Forex คือความไม่แน่นอน

EUR/USD Forecast November 13, 2012,By FX Empire Analyst - Christopher Lewis

The EUR/USD pair fell again during the session on Monday, as we currently hover above the 1.27 handle. This level is the bottom of significant support from the previous consolidation area. We had a significant high back in June at the 1.27 level before falling precipitously. It is this resistance that is now acting as support, and as such we think a lot will be learned about the Euro at this level.

If we can get below the 1.27 level for the daily close, this market should fall to the 1.25 level with relative ease. If that level gives way, we could see a move back down to the 1.20 handle before it’s all said and done. Remember, there are plenty of reasons to short the Euro right now, and it is a bit of a paradox but the United States dollar should continue to gain in value as long as the Americans cannot get their fiscal house in order.

The Dollar will rise over time even when the problem is US centric as the U.S. Treasury market suddenly becomes a safe haven. As long as that’s the case, we will find it very difficult to short the dollar for anything more than a quick trade.

The Euro suffers from having such situations as Greece and its economic problems, the Spanish bond market, and civil unrest in several different countries. With this being said, why would you want to own the Euro?

As far as the upside is concerned, we would have to close well above the 1.28 level in order to be convinced that we would be reentering the previous consolidation area. This doesn’t seem likely at this point time, but it is certainly possible if that happens, we would expect a return to the 1.3150 level, and also would expect that it would coincide with some type of announcement out of Europe. Presently, there doesn’t seem to be much in the way of planning or working on the European debt situation. We have simply “drifted” through the crisis. Sooner or later, the markets will make the Europeans pay, and progress will have to be made. Until then, we can only play the charts.

EURUSD Forecast 13/11/2012 Daily

EURUSD 13/11/2012 H1

คาดการณ์ว่า น่าจะลงได้อีกนิด จนทำ new low สำเร็จ

จากนั้นขึ้นไปพักตัว ถึงช่วง 1.2715 - 1.2740 (หรืออาจจะต่ำกว่า 1.2715 ราวๆ Support 1)

โอกาส Sell 70% จุดเข้า ตั้งแต่ Support 1(1.2699) - Resistance 2 (1.2740)

ถ้าราคา ผ่าน Resistance 2 (1.2740) ได้ ให้ Buy ตามน้ำไป โดย lot เป็น 3 เท่าของที่เปิด Sell ทั้งหมดรวมกัน

วันจันทร์ที่ 12 พฤศจิกายน พ.ศ. 2555

EUR/USD Forecast November 12, 2012,By FX Empire Analyst - Christopher Lewis

EUR/USD rallied initially on Friday, but failed to get above the 1.28 level which should now be resistance. Because of that break down, we believe that this pair goes much lower, perhaps as low as 1.24 before it’s all said and done. However, we have held steady at the 1.27 level, and it does appear that there is a little bit of support at this area. Because of this, we will wait until we break below the lows from the Friday session in order to start selling. As for buying this pair, we would have to break above the shooting star from Wednesday as it would show a significant switch in momentum.

EURUSD Forecast 12/11/2012 Daily

EURUSD 12/11/2012 D1

คาดการณ์ว่าในช่วงวันที่ 12 - 16 /11/2012 ขึ้นเพื่อมาพักตัวแล้วลงต่อ

จุดเข้า (Sell)

- 76.4 (1.2767)

- 61.8 (1.2815)

- 50 (1.2855)

- 38.2 (1.2894)

จุดแก้ทาง

- 23.6 (1.2942) เปิด Lot 3 เท่า ของที่เปิด order sell รวมกันทั้งหมด

TP 127.2 (1.2599)

วันศุกร์ที่ 9 พฤศจิกายน พ.ศ. 2555

EUR/USD Forecast November 9, 2012,By FX Empire Analyst - Christopher Lewis

The EUR/USD pair fell during much of the session on Thursday as the bottom of the shooting star from Wednesday got broken to the downside. However, by the end of the session we saw buying at the 1.2715 level.

This pair has been rocked by the revelations that Germany is about to head into a recession. The European Union is now a day by day affair again, and markets will focus on one side of the Atlantic or the other and back and forth. With the “fiscal cliff” looming in the near-term, the United States has its own set of problems as well.

Spanish yields are starting to rise in the bond markets again, and this of course rates a lot of confusion and fear about owning the Euro. There really was no place to hide during the session on Thursday, as anything risk related sold off. The 1.2800 level getting broken to the downside was certainly a big event, but we still see quite a bit of reluctance to short, probably based upon the whole idea of the government been so splintered in the United States and an inability to fix the budget issues.

The candle for the Thursday session is a bit of a doji, and as a result it represents confusion. Looking at the chart, we think that a move back above the 1.28 level would be bullish, but would we even be more bullish is that we could break the top of the Thursday shooting star. Until that happens, we are not comfortable buying the Euro.

Alternately, if we managed to break the bottom of the Thursday session, we would become aggressively short this pair all the way down to the 1.26 handle. We believe that this is the most likely of pass, but there could be a bit of a bounce on Friday as traders simply will not want to carry too much risk in one direction or the other over the weekend. We do think the rallies will present opportunities to sell though, and we think that the Euro should grind lower over time.

วันพฤหัสบดีที่ 8 พฤศจิกายน พ.ศ. 2555

EUR/USD Forecast November 8, 2012,By FX Empire Analyst - Christopher Lewis

EUR/USD initially spiked during the session on Wednesday with the Obama reelection, as it was thought that the US dollar would be devalued through more quantitative easing and extreme spending. Although this is probably still the case, it was suggested by the ECB Chairman that Germany has started a slowdown, and this is the last vestiges of strength leaving the European Union. Because of this, we could see this pair fall, but the reality is that the United States may be the Euro’s best friend as they are not exactly strong either. Nonetheless, we think a break of the lows from Wednesday since this pair looking for the 1.26 level in the short-term. As far as buying is concerned, a break above the highs from Wednesday would be extremely bullish sign.

วันพุธที่ 7 พฤศจิกายน พ.ศ. 2555

EUR/USD Forecast November 7, 2012,By FX Empire Analyst - Christopher Lewis

The EUR/USD pair fell below the 1.28 level for the second day in a row on Tuesday, only to pop back up and form a hammer yet again. The Euro is showing a significant amount of resilience of this area, and as such it’s hard to think that we will fall precipitously in the near-term. However, with the US Presidential election happening during the session, the election results will certainly have a major affect on this pair.

The traders essentially a binary one, but should not be taken until the election results become either known, or at least clear and where they are going. A break of the highs from the Monday session would have us buying the Euro as it should return to the 1.30 level. A break of the lows from the Tuesday session would have us selling the Euro hand over fist as it would show a falling down to the 1.26 level is very likely.

EURUSD Forecast 7/11/2012 Daily

EURUSD 7/11/2012 H1

จากวันที่ 6/11/2012 ตอนดึก เหมือนว่าจะสามารถผ่านแนวต้าน 1.2815 ได้ แต่ก้อลงมาอีก

วันนี้คาดการว่า อาจจะ sideway ในช่วง 1.2825 - 1.2762

(ถ้าสหรัฐเลือกตั้งประธานาธิบดีเสร็จกราฟอาจมีการกระชาก)

ถ้าผ่าน 1.2825 ไปได้ Buy ได้เลย

ถ้าผ่าน 1.2762 ไปได้ Sell ได้เลย

วันอังคารที่ 6 พฤศจิกายน พ.ศ. 2555

EUR/USD Forecast November 6, 2012,By FX Empire Analyst - Christopher Lewis

The EUR/USD pair fell during the Monday session, but got a bit of a bounce once the market fell below the 1.28 level. The resulting candle is somewhat hammer like, but this sets up a very obvious short position if we managed to break the lows of the day. This would not only break the session lows, but a significant low put in back during the middle of September. If that gives violated, this market should make a run down to the 1.26 level in relatively short order. As far as buying is concerned, we would only do so on a break of the highs from the Monday session. The that move would more than likely find 1.30 as far too resistive.

EURUSD Forecast 6/11/2012 Daily

EURUSD 6/11/2012 D1 Daily

ในช่วงวันที่ 6 - 9 /11/2012 คาดว่าอาจจะลงมาได้อีกนิดนึง จากนั้นขึ้นไปพักตัว ประมาณ 1.2880 และลงต่อ อาจจะถึง 1.2495 คงใช้เวลาซัก 1 อาทิตย์

วันจันทร์ที่ 5 พฤศจิกายน พ.ศ. 2555

EURUSD Forecast 5/11/2012 Daily

5/11/2012 EURUSD H4

ตอนนี้ H4 เป็นขาลง คาดว่าน่าจะขึ้นไปพักตัว ประมาณ 1.2855 - 1.2919 และน่าจะลงมาต่อ

จุดเข้า Sell ที่ 76.4(1.2855) , 61.8(1.2879) , 50(1.2899) , 38.2(1.2919) --> TP 127.2(1.2771)

ถ้ามาถึง 23.6(1.2943) ให้ Buy ตามน้ำ Lot 3 เท่าของ order ทั้งหมดที่เปิดรวมกัน --> TP จำนวนจุดเท่ากับ TP ของ ระยะที่ 1.2855 ถึง 1.2771

*** คาดว่าลงต่อ 70%

วันศุกร์ที่ 2 พฤศจิกายน พ.ศ. 2555

EURUSD Forecast 2/11/2012 Mid daily

2/11/2012 Mid daily

จุดเข้า (Sell) Fibo ที่ 76.4 (1.2912) , 61.8(1.2925), 50(1.2936) , 38.2(1.2947)

ถ้ามาถึงที่ Fibo 23.6(1.2960) ให้ Buy lot 3 เท่า ของที่เข้า sell ไปทั้งหมด

*** ไม่ขึ้นก็ลง เข้าผิดทางก็เข้าให้ถูกทางซะ ***

สมัครสมาชิก:

บทความ (Atom)