Weekly Price Action Trading Outlook for February 11th to February 15th 2013

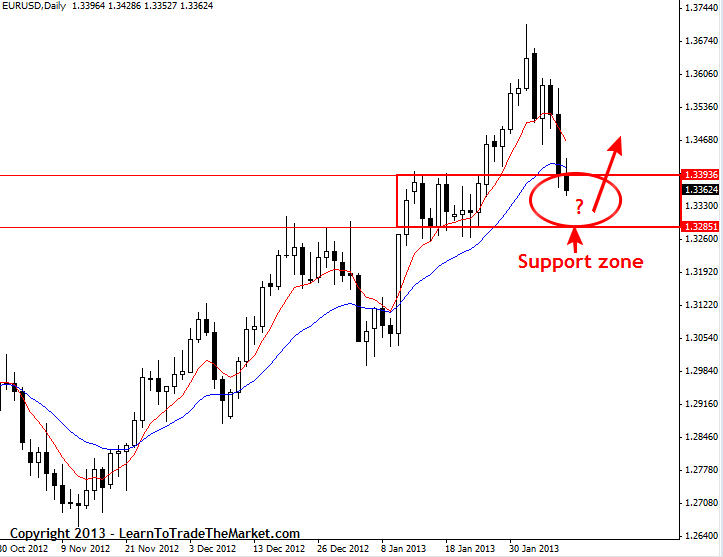

EURUSD – Euro/dollar continues to retrace lower, uptrend still intact

When we discussed the EURUSD in last Monday’s commentary, we talked about how the market was rotating lower from the highs on February 1st. Since then, the market has continued lower and broken down past 1.3410 support and is now within the support / value range between 1.3410-1.3265 area. This week, we could see this market continue to rotate lower within this support zone, and we will be watching for price action buy signals from within this support zone whilst the market stays above 1.3265 on a closing basis. Keep a close eye on support at 1.3300 if the market moves down into that level early this week, it would be a good level to see a price action buy signal form at to potentially get long and trade back with the up trend.

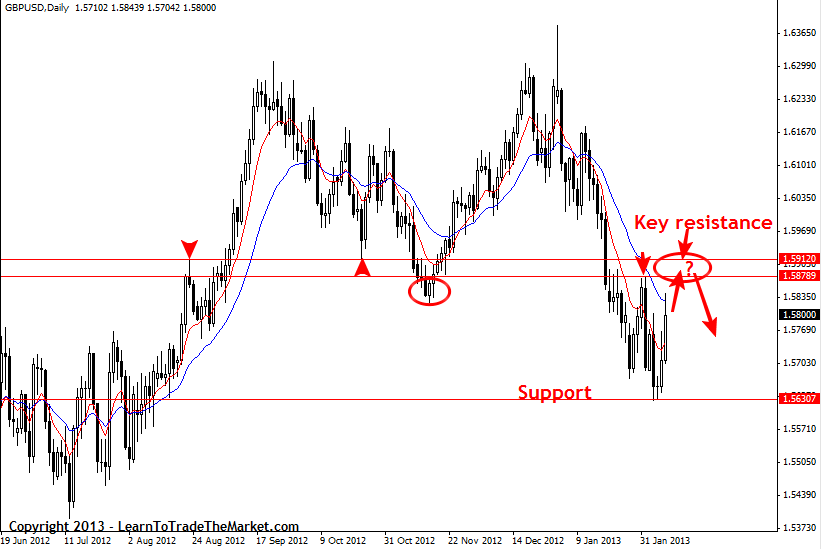

GBPUSD – Sterling/dollar rotates higher but contained below key resistance

The GBPUSD rotated higher last week as traders took profits on the recent downtrend into week’s end. We can see a very important area of key resistance coming in close overhead around 1.5875 – 1.5912. This week, traders should keep an eye on that resistance if the market continues to rotate higher, as it would be a good level to sell from if an obvious 4 hour or daily chart price action reversal signal formed there. If the market closes above that 1.5912 resistance level we would then begin to back off our bearish bias and take a more neutral stance on this market.

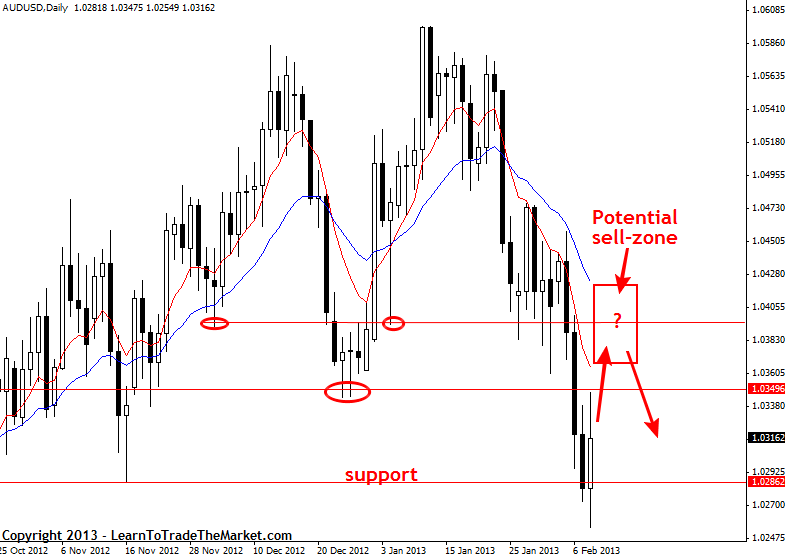

AUDUSD - Aussie/dollar; looking to sell on a retrace higher

The AUDUSD has been falling lower over the past three weeks but on Friday it appeared to have found some support from 1.0280 area. This week, we will be watching for a sell-signal from resistance if this market continues to retrace higher. Watch the dynamic resistance layer between the 8 and 21 day EMAs and horizontal resistance near 1.0400 for price action sell signals to trade back in-line with the bearish momentum in this market.

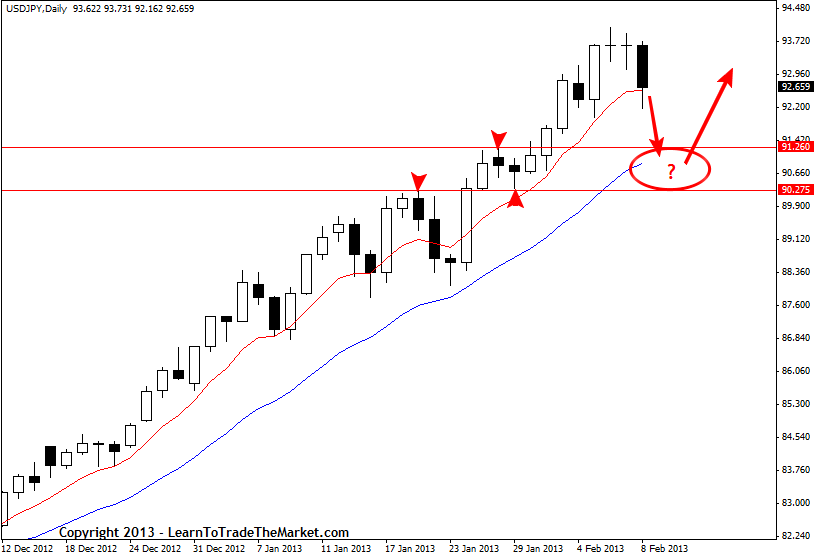

USDJPY – Dollar/yen uptrend intact; watching support for buy signals

The USDJPY lost ground on Friday as the uptrend took a breather and price rotated back down to the 8 day EMA dynamic support level. This week, if the market keeps retracing lower, we will keep our eyes on support for buy signals to trade back in-line with the uptrend. The next obvious support area comes in between 91.25 – 90.25 and if price moves into that support zone this week we will watch for a nice 4 hour or daily chart price action buy signal to trade with the trend in this market.

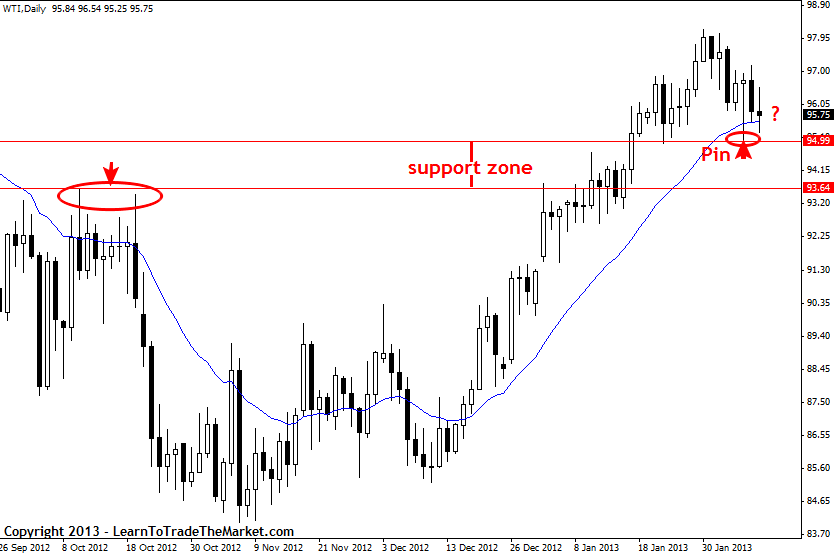

WTI – Spot Crude oil fakey / pin bar setup update

The spot Crude Oil market has basically went sideways since we last discussed the fakey pin bar combo setup in our commentary from last Wednesday. Price has drifted lower to just beyond the pin bar 50% level but has not violated its low yet, so the signal has not been invalidated yet. However, there is a key zone of support from about 95.00 down to 93.60 area, so we could see this market move lower yet into that zone before it does continue higher. If that happens, we would continue to watch for buy signals forming from within that support as the weekly chart is still showing a healthy uptrend in place in this market.

ไม่มีความคิดเห็น:

แสดงความคิดเห็น